By: Jay Whitney

A childcare center business valuation needs a reasonability test. One critique is a purchase price justification test, which confirms whether a lending institution could finance the childcare business at its estimated value to a qualified buyer with a reasonable equity stake. This test confirms whether a business’s cash flow can finance the acquisition debt, provide a return to the investor, and compensate the new owner operator for the time and effort that the new owner puts into the business.

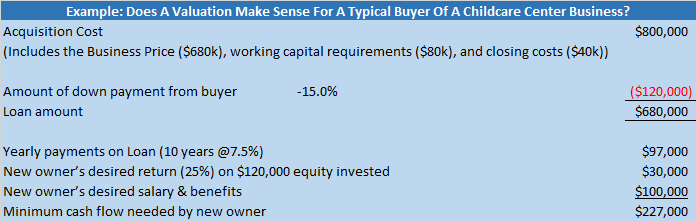

Potential business buyers value a childcare business using the debt-paying ability of the business. Most business buyers are required by lenders to provide a 10% to 20% down payment of the Total Acquisition Price of a childcare center, therefore, a typical childcare business buyer finances 80% to 90% of the Total Acquisition Price. The Seller’s Discretionary Earnings (SDE or “cash flow”) of the business should support the debt service, return on equity invested, and compensation for the new owner. A simple example:

In this example, a Total Acquisition Cost of $800,000 supports the debt service, return on equity invested, and owner’s compensation as long as the SDE/cash flow is at least $227,000. If the cash flow was exactly $227,000, a higher acquisition cost would not support the debt service, unless the business buyer was able to get better terms on the debt, or would require less than $100,000 compensation or less than a 25% return on the money invested. This confirms to the buyer that a multiple of 3 times the SDE is acceptable.

In this example, the total yearly cash flow available to the new owner is $130,000. Note that this example simplifies many factors, including the deal structure and the resulting effect on taxes which in turn affects the cash flow, and therefore the price.

Contact us to discuss childcare valuations, or request a valuation.

JayWhitney@ChildcareBrokers.com 770-410-7582