The below spreadsheet will help you to determine the real SAVING by refinancing your childcare center.

If you are thinking of refinancing your childcare center, it is a good idea to determine how much you will save in loan interest: 1) each month, 2) over the next year, 3) over the next 5 years, and 4) over the term of the loan.

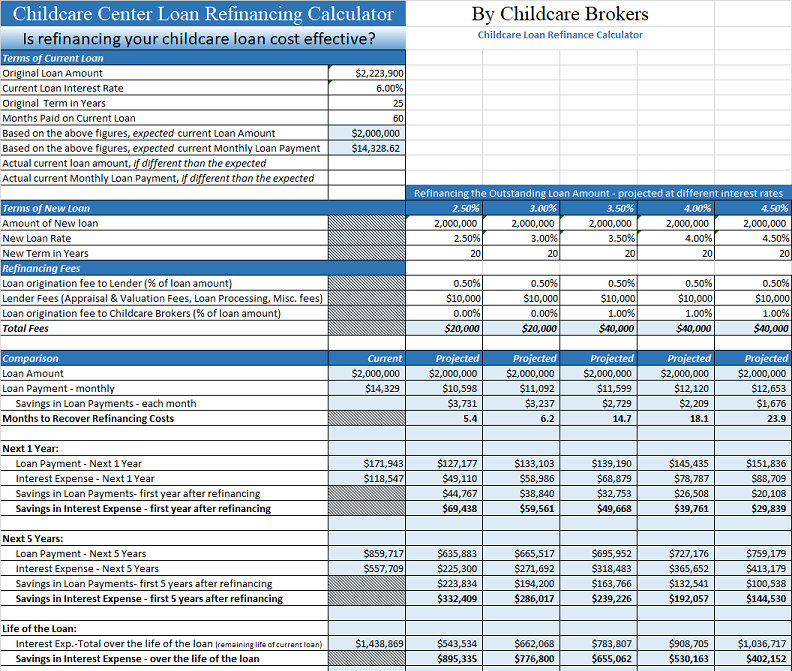

Example – Refinancing a childcare center which currently has a SBA loan with a current balance of $2.0 million, variable interest rate at the Prime Rate plus 2.75% with 25 year term. The current interest rate is 6%. The loan was made 5 year ago. Monthly payments are $14,328.

For franchised childcare centers, that are doing well, the interest rate will likely be 2.5% to 3.5%. If you can refinance at 3%, the monthly payments would be $11,092, and the savings would be: 1) $59k during the first year, 2) $286k during the first 5 years, and 3) $776k over the life of the loan.

For independent childcare centers, that are doing well, the interest rate will likely be 3.5% to 4.5%. If you can refinance at 4%, the monthly payments would be $12,120, and the savings would be: 1) $39k during the first year, 2) $192k during the first 5 years, and 3) $530k over the life of the loan.

The Prime Rate at of August, 2021 is 3.25%, so this is a great time to refinance.

The above example has the interest percentage rate of your current Loan at 6% FIXED. If your current rate is an adjustable Loan (as typically of most SBA 7(a) loans), your interest rate is likely at all time low rate. In this case, to calculate the cost of keeping your current loan, you maybe should use: 1) the current interest rate you are paying (the 6% per the above example), 2) the average interest rate you have been paying (likely, your average interest rate over the last few years was 7.5% to 8% if your interest rate was the prime rate plus 2.75%) , and 3) an interest rate 1% higher than you are current paying (7%). Using these three alternative interest rates will give you a better understanding of how much you will SAVE if there are changes in your variable interest rate.

To determine how much you will save using each of these different scenarios, download the above Childcare Center Loan Refinancing Calculator.

If You Are Considering Refinancing Your Childcare Center’s SBA Loan Or Conventional Commercial Loan, You Should Consider The Following:

- How much can you benefit from refinancing through lower interest rates or lower monthly payments?

- Since all refinancing has closing fees, is it worthwhile to refinance?

- How else can you benefit? For example,

- If you have an impending balloon payment, you may want to secure a new loan without any balloon payments.

- If you have a variable interest rate, you may want to reduce your risk from interest rate increases, by getting a fixed interest rate loan.

To help you figure out if it makes financial sense for you to refinance your current loan; the bank closing fees to refinance into a $1.0 million conventional commercial loan for a childcare center would typically be up to $25k to $30k. For a $2.0 million conventional loan, the bank closing fees are typically up to $35k to $40k. However, each lender is different. For my best lender for franchised childcare centers, the total loan closing fees for a $2.0 million loan are normally $15k to $20k.

The closing fees to finance into a $1.0 million SBA 7(a) loan for a childcare center would typically be $30k to $35k (this includes the $22,500 SBA guarantee fee). For a $2.0 million SBA 7(a) loan, the closing fees will typically be $60k to $65k (this includes the $53,750 SBA guarantee fee). Closing fees for SBA 504 and USDA B&I loans are very similar to SBA 7(a) loans.

Closing fees can be rolled into the new loan and financed (if the cash flow and the loan to value ratio permits it).

How Much You Can Save By Refinancing Your Current Loan? Submit your information online if you are interested in refinancing an existing Childcare Center loan.

Complete an online application and submit it now.

JayWhitney@ChildcareBrokers.com 770-410-7582